Caliber's InDIVIDUAL Investor Funds

For accredited investors seeking to diversify their portfolios using Private Equity Real Estate (PERE).

Investments in private placements can lose entire value, are illiquid and are speculative

Current Fund Asset

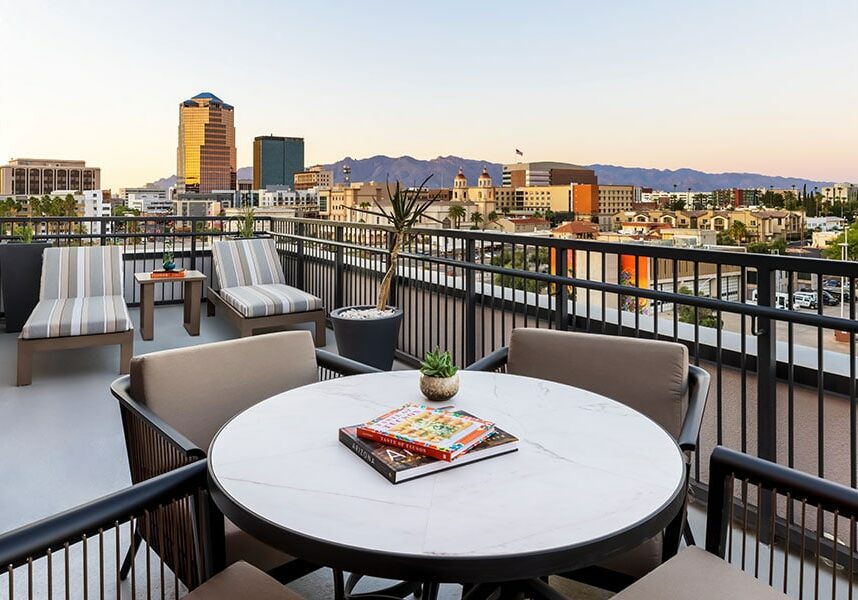

Caliber Tax Advantaged Opportunity Zone Fund II, LLC

RESIDENTIAL • COMMERCIAL • HOSPITALITY

The Caliber Tax Advantaged Opportunity Zone Fund II is targeting QOZ opportunities across the greater Southwest U.S. including Arizona, Texas, Colorado, Nevada and Utah. Caliber believes these states have the potential to possess some of the top Qualified Opportunity Zones due to long-term population and job growth trends.

Potential Fund Asset

(Conceptual Rendering)

Caliber Opportunistic Growth Fund LLC

MULTI-FAMILY • COMMERCIAL • INDUSTRIAL

The Caliber Opportunistic Growth III Fund LLC leverages the experience gained from Caliber's previous multi-asset developments to provide you with attractive risk-adjusted returns. The fund is purchasing a blend of development and value-add properties so that you can potentially receive distributions early in the fund's life cycle.

Concept Image Only

Caliber Fixed Income Fund III, LP

LENDING WITH TARGETED MONTHLY RETURNS

This funds plans to lend privately on a variety of assets with the potential to create monthly income. The Caliber Fixed Income Fund III leverages the experience gained from our previous two Fixed Income Funds to offer our limited partners the potential to achieve their desired income-related goals. Leveraging our experienced team, Caliber will source, originate, and service private loans with the potential for monthly distributions.

Potential Fund Asset

Caliber Core+ Growth & Income Fund, LLC

MULTI-FAMILY • COMMERCIAL • INDUSTRIAL

Core Plus is a diversified portfolio of real estate properties, REITs and other real estate related assets that are considered Core or Core Plus in nature. The fund will seek income-producing assets that are typically found in the Core and Core Plus strategies, which are known for their stable returns and lower risk profile.

Contributed Fund Asset

Caliber Hospitality Trust, Inc. Class B & Class C Preferred Stock

HOSPITALITY • COMMERCIAL

This offering capitalizes on a unique opportunity to acquire discounted hotels, offering investors access to both long-term growth and steady income. The key features of this stock include ‘preferred status,’ high yield distributions (passive income), long-term capital growth, and the continual growth of our hotel portfolio that currently holds 42 assets in 18 markets across the U.S.

What is an individual accredited investor?

An accredited investor is a person or a business entity that is allowed to trade securities that may not be registered with the Securities and Exchange Commission (SEC). These groups are entitled to advantaged access to private securities by qualifying for at least one requirement from either their income, net worth, asset size, governance status, or professional experience.

8 Reasons why you should invest in funds managed by Caliber

-

-

Founded in 2009, we are a leading vertically integrated asset management firm whose primary goal is to enhance your wealth making investments in middle-market assets.

-

We strive to build wealth for you by creating, managing, and servicing proprietary products, including middle-market investment funds, private syndications, and direct investments.

-

Our funds include investment vehicles focused primarily on real estate, private equity, and debt facilities.

-

We earn asset management fees calculated as a percentage of managed capital in our Funds and Offerings. We market our services through direct sales to private investors, wholesaling to investment advisers, direct sales to family offices and institutions, and through in-house client services.

- Our Qualified Opportunity Zone Fund II (QOZF II)* can offer you the following potential benefits:

- Defer tax liability on realized capital gains

- Eliminate capital gains on growth of investment if held for 10 years

- Potentially unlocking compounding capital gains

- Help improve economic conditions in underprivileged areas

- Our Caliber Opportunity Growth Fund (COGF)** can offer you the following potential benefits:

- Fund diversification in real estate markets, types, locations, investment strategies and techniques

- We seek to purchase properties at discount, then build additional value through development, construction, and active management

- Our Fixed Income Fund can offer you the following potential benefits:

- Fixed rate distributions on invested capital

- Investment in mezzanine debt which is generally a higher yielding alternative to bonds

- Investors can request a redemption after a 12-month hold period

- Investors can add to their investment at any time

- Our syndications typically offer short to intermediate term holding periods for those seeking income, growth or a blend of the two. A few of the syndications we offer accept investments using a self-directed IRA and traditional cash.

-

*QOZF II is an offering open to investment that is developing from the momentum, success and experience attained from our previous QOZF I, which is closed to new investments.

** COGF is an offering open to investment that is developing from the momentum, success and experience attained from our previous offering: Caliber Diversified Opportunity Fund (CDOF II), which is closed to new investment. The name of the fund is updated to reflect a more accurate representation of our strategy.

133-SKY-011324

Sign in or Sign up to view further offering details

Already have an account?

Log in Here